CryptOps ChronicleCryptOps Chronicle September 2023 Report

CryptOpsChronicle: September 2023 Report

Welcome to the CryptOpsChronicle September 2023 report. In this third installment of our series, we will delve into the developments in the crypto and crypto derivatives sectors during September and thoroughly examine investors’ positive and negative experiences.

As you may recall, the crypto sector entered one of the slowest periods of 2023 in August. Trading volumes had plummeted to the lowest in years, and volatility had decreased significantly. However, September held hope among investors for reversing this negative trend. Numerous developments in the NFT, blockchain, and crypto sectors provided data that supported this hope. In this section of the CryptOpsChronicle report, we will explore the developments in September and assess whether the expectations were met.

Key Highlights

Google Updates Policies, Allows Ads for NFT-Based Games: Google announced an update to its advertising policy for the crypto sector, allowing ads for NFT-based games on the blockchain. However, these games were required to meet conditions that did not promote gambling.

Bitcoin Sets a New Record: The Bitcoin blockchain achieved an all-time high with a total of 703,692 transactions in one day, including 440,760 ordinal transactions, validated by miners.

SEC Delays 7 Applications for Spot Bitcoin ETFs: The U.S. Securities and Exchange Commission (SEC) announced that it had postponed its decision on seven eagerly awaited applications for spot Bitcoin ETFs, leading to a 5% drop in the price of Bitcoin.

Twitter Acquires Necessary License for Crypto Payments: Social media giant Twitter, formerly known as X, acquired a new license for crypto payments to expand its payment processing capabilities on the platform.

Telegram Integrates a Crypto Wallet Based on TON: Telegram announced that it had officially integrated The Open Network (TON) into its Web3 infrastructure and integrated the “TON Space” crypto wallet into its application.

Google Cloud Adds Support for 11 Blockchains to its Analytics Service: Google Cloud announced the addition of support for 11 more blockchains to its BigQuery open data program. Among the featured blockchains were Polkadot, Avalanche, Polygon, and Near, which have recently gained significant attention and usage.

Crypto

Key Highlights

Sudden Bitcoin Price Drop: Bitcoin’s price experienced a sudden plummet on August 18, dropping by over 8% in just 10 minutes.

Coca-Cola Unveils “Masterpiece” NFT Collection: Coca-Cola introduced the “Masterpiece” NFT collection on Coinbase’s Ethereum Layer 2 network, Base, showcasing a fusion of traditional and modern art pieces.

Bitcoin Mining Difficulty Reaches All-Time High: Despite the rapid decline in Bitcoin’s price, BTC mining difficulty reached a historic peak of 55.62T hashes.

Current State of the NFT Market: In August, the NFT market faced challenges such as declining volumes and lower profits for individual investors. However, despite this, the NFT market closed August with total sales exceeding $40 billion, surpassing the previous year’s total.

Binance Signals Entry into P2E Gaming: The GameFi sector, which experienced dramatic declines of up to 98% for top play-to-earn tokens like SAND, AXS, and GALA during the past summer, has come to life with a play-to-earn project signal from Binance’s official X account.

Grayscale Has Won the Bitcoin ETF Case Against the SEC: The court’s decision to review Grayscale’s ETF proposal has led to a significant increase in the price of BTC, pushing it back above the $28,000 level with a notable 5% rise.

Crypto

Overview of the Crypto Market:

September brought significant developments to the crypto market. Federal Reserve Chairman Jerome Powell’s remarks about tight monetary policy and high-interest rates led to a decline in the market. Both Bitcoin and Ethereum experienced losses. Bitcoin dropped below $26,600 but showed signs of recovery in recent days. Ethereum, on the other hand, fell below $1,600, exhibiting weaker performance compared to Bitcoin.

The U.S. Consumer Price Index (CPI) also increased significantly, particularly due to rising gasoline prices. The Federal Reserve’s adoption of a tighter monetary policy impacted traditional financial markets, which is expected to affect the crypto market downward in the coming period.

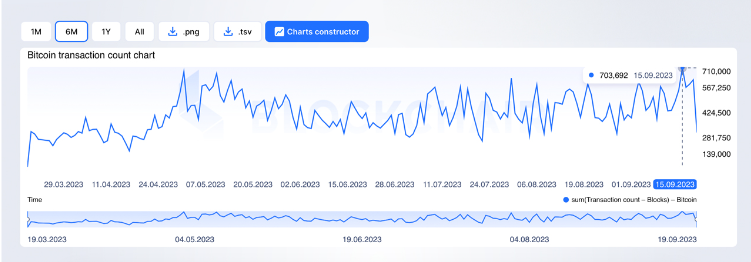

During this period, however, the Bitcoin blockchain set a historic record. It recorded the highest number of transactions validated by miners in a single day, totaling 703,692, including 440,760 ordinal transactions.

SEC Delays 7 Applications for Spot Bitcoin ETFs:

The SEC announced that it had postponed its decision on seven Bitcoin ETF applications, including those from major asset managers like BlackRock. The SEC was supposed to evaluate these seven applications by September 4th. However, the decision was delayed by 45 days, extending the deadline to mid-October.

Bitcoin Witnesses Over 703,000 Transactions in a Single Day:

On September 15, 2023, the Bitcoin blockchain achieved a historic milestone by confirming the highest number of transactions in a single day. This number was recorded as the highest level ever.

Miners validated a total of 703,692 transactions, including 440,760 ordinal transactions, surpassing the previous record of 682,281 transactions on May 1, 2023.

Telegram Integrates a Crypto Wallet Based on TON:

Telegram recently announced the integration of a TON blockchain-based crypto wallet into its messaging platform. As a popular messaging application with over 800 million users, this move caused a significant 10% increase in the price of TON, the native currency of the TON network.

With this integration, users can now send and receive TON Crystal tokens, the native currency of the TON network, directly from their Telegram chats.

NFT:

Overview of the NFT Market:

Recent data continues to indicate a downward trend in the NFT sector. NFT sales saw a continued decline in September, with sales in the final week of September reaching $78.88 million, a 3.2% decrease compared to the previous week. Overall, there was a 34% decrease in NFT sales during the past month. As of the end of September, NFT sales reached $341.37 million since August 24.

September 2023 NFT Market Data:

- Total NFT Market Market Cap: $4.6 billion

- Daily NFT Trading Volume: $370.4 million

- Total NFT Transaction Count: 991.7k

- Total Unique User Count: 248.2k

- Buyer/Seller Ratio: 104.82%

In September, NFT collections in terms of trading volume were ranked as follows:

Mutant Ape Yacht Club remained at the top, showing resilience despite a slight decrease. These unique mutant apes continue to capture the imagination of NFT enthusiasts.

- 7-Day Trading Volume: $9.26 million

- Volume Change: -1.39%

Bored Ape Yacht Club, a prominent competitor to the Mutant Ape collection, maintained its position as an influential player in the NFT space despite a significant decrease.

- 7-Day Trading Volume: $7.46 million

- Volume Change: -24.34%

Gods Unchained, which combines the appeal of collectible cards with the power of NFTs, held its strong presence in the third position. The collection’s unique gaming items and detailed artworks make it appealing.

- 7-Day Trading Volume: $4.36 million

- Volume Change: -14.74%

Google Updates Policies, Allows Ads for NFT-Based Games:

Google updated its advertising policy for the crypto sector, allowing ads for NFT-based games on the blockchain. However, these games were required to meet conditions that did not promote gambling. According to Google’s blog post, the new changes took effect on September 15, 2023, and projects meeting the criteria could advertise their NFT-based games from that date onwards.

Pokémon NFTs Start Selling on Polygon (MATIC) Blockchain:

The legendary anime Pokémon’s NFT cards, developed by Courtyard, began selling on the Polygon (MATIC) blockchain. Investors and collectors quickly drove up the base prices and purchased the digital collections within seconds after the sale began.

The two-stage sale of Pokémon cards on the Polygon blockchain was successfully completed. According to digital asset analyst S4mmy.eth, organizers also accepted fiat payments via credit cards alongside the stablecoin USD Coin (USDC).

GameFi:

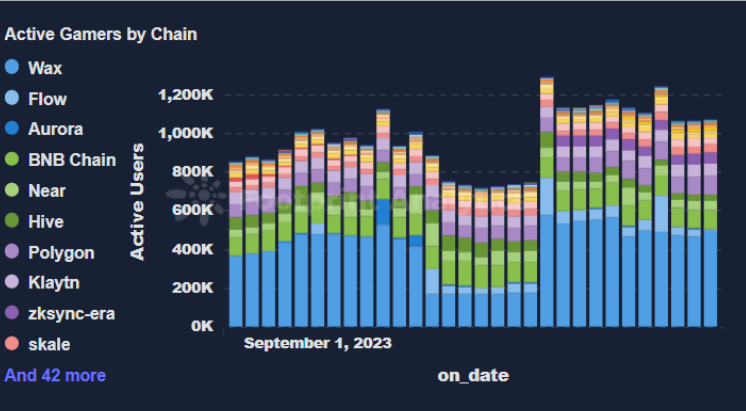

Overview of the GameFi Market:

- As of September 2023, the total volume of the GameFi market reached $4,519.89 million.

- The average daily total transaction count for September in the GameFi market was recorded at 22,690,932.

- The most popular web 3-based game in September was Farmers Worlds, with an average of 335,000 active users.

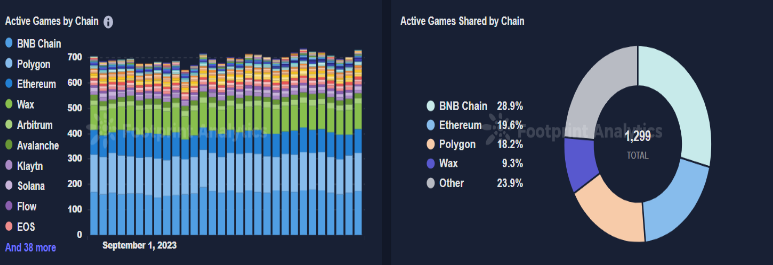

- The total number of games in the market decreased by approximately 0.7015% compared to the previous month, falling from 2,566 to 2,584.

- BNB Chain led in terms of the most games, accounting for 28.9%, followed by Ethereum at 19.6%.

Famous Game Developer Nekki Announces Its First Web3 Game:

Nekki, a leading producer of high-quality action and strategy Web2 games, announced that it plans to release its first Web3 game, ‘Fight Me,’ in 2024. The team has created numerous successful projects for different platforms, including the multi-platform fighting game series Shadow Fight and the parkour runner Vector, attracting the interest of over 1 billion players worldwide. The publishing brand now aims to step into the next level of the gaming world, offering an innovative Web3 approach to audience engagement and monetization.

One of the Founders of Farmville Raises $33 Million to Create Web3 Games:

Proof of Play, a company led by Amitt Mahajan, co-creator of the globally renowned mobile game Farmville developed by Zynga, announced on September 21 that it had raised $33 million to create Web3 games. The company claimed that it could overcome many obstacles that players often encounter when trying to play Web3 games without prior knowledge of blockchain. They mentioned a “series of technological and product innovations” designed to quickly involve players in a fun gaming experience while bypassing the need for external crypto wallets or seed phrases.

Blockchain:

Overview of the Blockchain Sector:

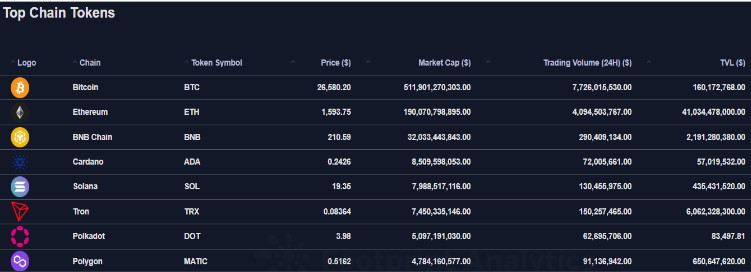

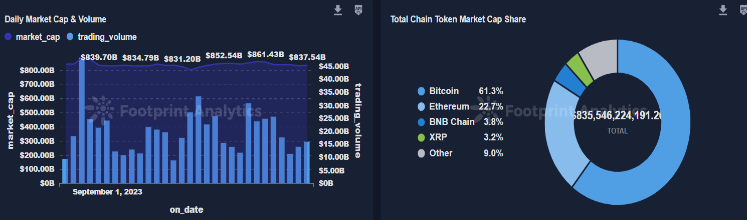

Based on data from September, the total Chain Token Market Cap in the blockchain ecosystem was $835.5 billion, and the Total Chain TVL (Total Locked Value) was $55.5 billion. The distribution of the Total Chain Token Market Cap was led by Bitcoin at 61.3%, followed by Ethereum at 22.7%. The top five were as follows:

- Bitcoin: 61.3%

- Ethereum: 22.7%

- BNB Chain: 3.9%

- XRP: 3.3%

- Others: 9.4%

Google Cloud Adds More Data Support for 11 Blockchains:

Google Cloud added support for 11 more blockchains to its BigQuery open data program. According to a blog post published on Thursday, users can now query data from Avalanche, Arbitrum, Cronos, Ethereum Goerli, Fantom, Near, Optimism, Polkadot, Polygon, Polygon Mumbai, and Tron.

Layer 2 Platform Base Surpasses $500 Million TVL Just 6 Weeks After Mainnet Launch:

Base, an Ethereum-based Layer 2 (L2) developed on the OP Stack by Optimism, is dominating the market share of the largest scalers. After explosive growth, the total estimated value locked (TVL) in decentralized finance (DeFi) protocols on Base reached $533 million in just six weeks, accounting for 5.15% of the total L2 segment volume.

Conclusion:

In this CryptOpsChronicle report, we have thoroughly examined the developments in the crypto and crypto derivatives sectors for September 2023. The report covers a wide range of topics, including the overall state of the crypto market, the current status of the NFT sector, policy updates by major tech companies like Google, developments in the blockchain ecosystem, and innovations in the gaming sector.

While September saw the crypto market attempting to recover from the August slowdown, the impact of Federal Reserve Chairman Jerome Powell’s statements and other macroeconomic factors was strongly felt. Although the Bitcoin blockchain demonstrated its technological strength by setting a transaction record, the SEC’s delay of spot Bitcoin ETF applications had a negative impact on crypto investors.

In the NFT market, a continued decline in NFT sales was observed, especially during September. However, certain NFT collections still appear to be attractive investment opportunities, as evidenced by their trading volumes.

Furthermore, the update to Google’s advertising policy, allowing ads for NFT-based games, provided a positive boost to the crypto sector.

Lastly, data on the blockchain technology and crypto asset ecosystem demonstrates continued growth and interest in the field. The addition of support for 11 more blockchains by Google Cloud and the rapid growth of Base, an Ethereum-based Layer 2 platform, are promising signals for the future of the industry.

We would like to extend our thanks to Footprints Analytics for providing us with the data used in the preparation of this report. The CryptOpsChronicle report will continue to serve as a valuable resource for participants in the crypto and crypto derivatives sectors, shedding light on significant developments and trends in the industry.