CryptOps ChronicleCryptOps Chronicle July 2023 Report

CryptOpsChronicle: July 2023 Report

Welcome to the July 2023 edition of CryptOpsChronicle, where we delve into the fascinating world of cryptocurrencies, NFTs, Blockchain Technologies, and the evolving GameFi Sector. In this comprehensive report, we aim to provide you with valuable insights and analysis on the most notable events, trends, and developments that shaped the financial landscape during this eventful month.

The crypto industry, known for its dynamic nature, continues to captivate investors, businesses, and tech enthusiasts alike. In July, the market experienced various exciting highs and challenging lows, as prominent cryptocurrencies faced regulatory scrutiny, NFTs soared in popularity, and GameFi sector saw shifting user trends.

Key Highlights

Ripple vs. SEC Lawsuit Conclusion: The long-awaited conclusion of the lawsuit between Ripple (XRP) and the US Securities and Exchange Commission (SEC) had a profound impact on the crypto money markets, reshaping investor sentiment and influencing altcoins’ performance.

The NFT Market Surge: The world of non-fungible tokens (NFTs) continued to thrive, driven by rising cryptocurrencies and major brand involvement. We analyze the surge in interest, market capitalization, and daily trading volumes.

Azuki NFT Collection Price Drop: A high-profile NFT collection, Azuki, witnessed a significant price drop after the release of a new NFT series, Elementals. We explore the reasons behind the decline and its implications.

GameFi Sector Dynamics: The GameFi sector experienced shifts in user trends, with BNB Chain leading the pack in active users. We examine the performance of major blockchain networks and their game offerings.

Ubisoft and Google’s Blockchain Endeavors: Tech giants Ubisoft and Google made notable entries into the blockchain space, signaling further mainstream adoption and innovation.

Blockchain Sector Growth: The blockchain market displayed steady growth throughout July, reaching a significant market capitalization. We highlight noteworthy developments in blockchain technologies.

Crypto

Overview of the Crypto Market

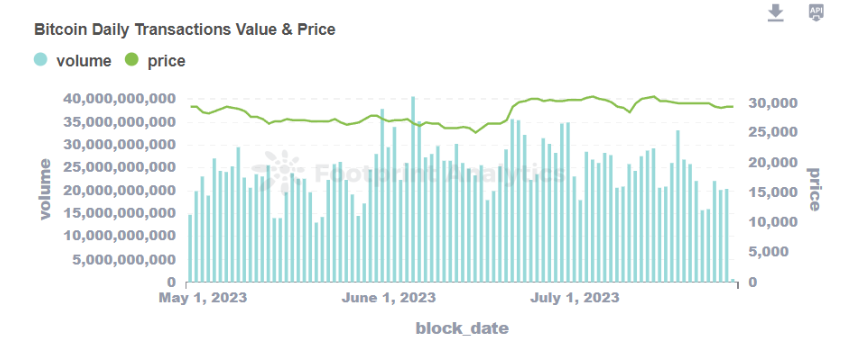

With BlackRock’s spot Bitcoin ETF application frenzy in June, July opened its doors to the conclusion of the lawsuit between Ripple (XRP) and the US Securities and Exchange Commission (SEC). Ripple was accused by the SEC of allegedly selling securities. This long litigation process was concluded this month. The conclusion of the case, of course, had significant effects on the crypto money markets. While there was no significant rise in Bitcoin compared to altcoins, the rise of Bitcoin in June again decreased to $ 29,000 as of the end of this month.

Twitter CEO Elon Musk changed the Twitter name and logo to “X” and used the expression 𝕏Ð. This situation caused the increase of DOGE Coin, which has an important place among MEME Coins. Seeing the highest level in recent times, Doge managed to become the focus of the attention of investors.

OpenAI Co-Founder Sam Altman Unveils Worldcoin Crypto Project

Worldcoin, a cryptocurrency project by OpenAI CEO Sam Altman, launched with its main offering, the World ID, which verifies users as real humans through an in-person iris scan using an orb.

The project had 2 million beta users and expanded to 35 cities in 20 countries. Users signing up in certain countries received the WLD cryptocurrency token, which saw a significant price increase on launch day, reaching a peak of $5.29 on Binance.

Ripple’s Legal Victory Propels XRP to 4th Place Among Top Cryptocurrencies

After a legal win against the SEC on July 13, Ripple’s XRP became the fourth largest cryptocurrency with a market cap of $46.1 billion, up $21.2 billion from before.

The court ruling stated that XRP sales on exchanges weren’t investment contracts, leading to a 98% surge in price to $0.93. Ripple’s market cap stabilized at $42.5 billion.

NFT

Overview of the NFT Market

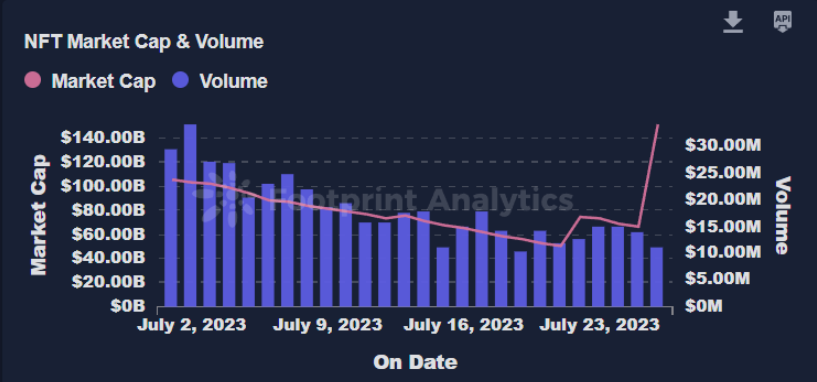

In July, the interest in the NFT market surged, especially due to the rise in the value of cryptocurrencies like Bitcoin and major brands experimenting with NFTs. However, not all projects experienced a rise in interest as some did not meet their expected levels of attention.

July 2023 NFT Market Data:

- Total NFT Market Capitalization: $151.5 billion

- Daily NFT Trading Volume: $596.8 million

- Total NFT Transactions: 1.2 million

- Total Unique Users: 395.3 thousand

- Buyer/Seller Ratio: 152.92%

During July and June, the total NFT market capitalization remained steady at $151.5 billion. However, in June, the market value reached $941.1 million with higher daily trading volumes and transaction numbers compared to July. In July, the daily NFT trading volume was recorded at $596.8 million. The buyer/seller ratio for July was calculated at 152.92%, indicating that there were more buyers than sellers, signifying that the market was predominantly driven by buyers.

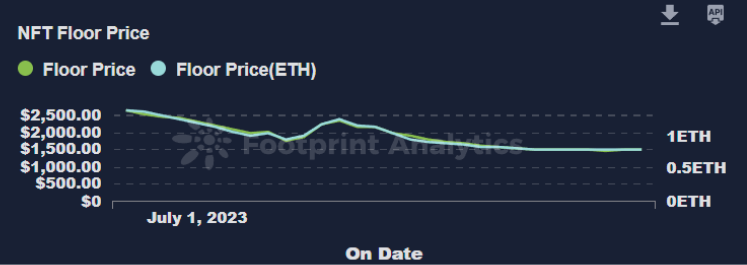

Azuki NFT Prices Drop by 44% After the Release of the Elementals Collection

On July 27, the popular Azuki NFT collection from Chiru Labs saw a significant drop of 44% in its base prices within 24 hours of releasing their new NFT series called Elementals.

The negative criticism from collectors and market observers, citing striking similarities to the previous collection, led NFT holders to sell their main Azuki collections, causing the prices of Elementals to fall below their initial values.

NFT Marketplace Blur Introduces Its Second Version

Blur, the NFT marketplace, introduced its second version with two notable improvements. The update reduced gas fees by 50%, resulting in approximately $16 decrease in NFT creation costs.

Additionally, the platform integrated the trait bidding feature, allowing traders to bid on specific attributes rather than offering bids on entire collections, thereby earning more points.

GameFi

Overview of the GameFi Market

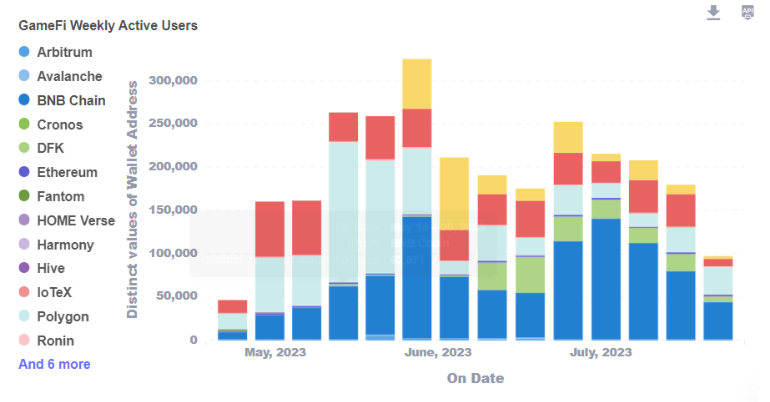

- In July, the GameFi sector experienced a decrease in the number of active users compared to June. Moreover, throughout July, there was a continued downward trend in the user count, starting from the beginning of the month.

- In July, BNB Chain maintained its superiority by achieving a significant increase of 154% in active users, reaching an average of 110,000 users. This impressive growth allowed BNB Chain to continue to outperform other blockchain networks.

- BNB Chain was followed by DFK, Polygon, and Solana, respectively, in terms of active user counts.

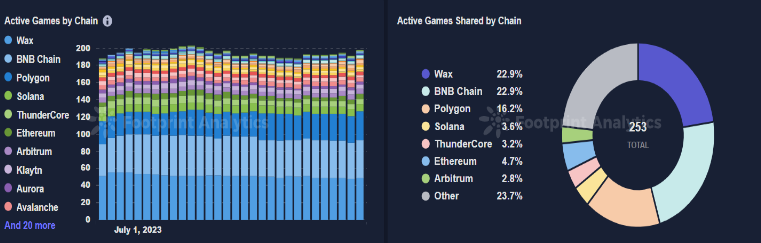

- In July, there was no significant change in the number of blockchain-based games. At the beginning of the month, the total active game count across major blockchain networks was 195, and as the month approached its end, this number increased to 198.

- The blockchain networks with the highest number of games accounted for 22.9% each of the total share. BNB Chain and Wax both held this 22.9% share in the number of games available on their respective platforms.

- The total market capitalization of GameFi tokens reached $5,584.14 million.

Ubisoft Announces Its First Blockchain-Based Game

Joining the rapidly growing Web 3 gaming world, Web 2 giant Ubisoft announced its first blockchain-based game, “Champions Tactics,” and released a trailer. However, the teaser did not provide detailed information about the gameplay or how blockchain technology would impact the game.

Google Supports NFTs on Android Play Store

In a historic move, Google updated its Play Store policies to allow and regulate blockchain-based games and NFTs in Android applications. The full implementation plan is expected to be completed by the end of the year.

Google emphasized the commitment to providing a secure and transparent experience for users and stated that apps must be transparent about tokenized digital assets.

Blockchain

Overview

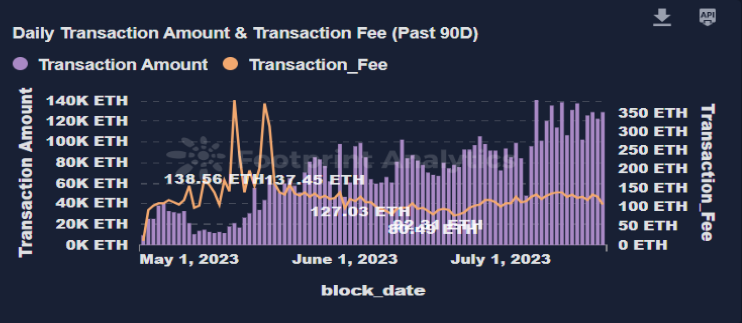

In July, the total Chain Token Market Capitalization reached $963.5 billion. Throughout the month, the market value fluctuated, reaching its highest value of $1.03491 trillion on July 13, before experiencing a slight dip on July 14. TVL for Chain Tokens ranged from $64.55 billion to $69.67 billion during the observed period, with the highest value observed on July 14. Overall, the market capitalization remained relatively stable with some fluctuations.

ZkSync Introduces ZK Stack

ZKSync Era, an Ethereum-based layer-2 solution, introduced ZK Stack, providing a modular framework for a series of private blockchains called Hyperchains. This solution aims to reduce transaction fees and deposit confirmation times.

Similar to Optimism’s Superchains, these chains will operate on top of the existing layer-2 protocol and be designed to be compatible with each other, enabling near-instant liquidity and credit transfers between protocols.

800.000th Block Mined on the Bitcoin Network

An important milestone was achieved in the Bitcoin network as the 800,000th block was successfully mined, leaving just 40,000 blocks to be mined before the next halving period.

On July 24th, Bitcoin surpassed the 800,000th block while the BTC price was hovering around $29,702. The 800,000th block consisted of 3,721 transactions and was 1.64 megabytes in size.

Binance Completes Integration of Bitcoin Lightning Network

Binance, the world’s largest cryptocurrency exchange, completed the integration of the Bitcoin Lightning Network into its BTC withdrawal and deposit platform. This allows users to utilize the second-layer scaling solution for faster and cheaper BTC transactions. By enabling the Lightning Network infrastructure, BTC transactions are expected to be faster and more cost-effective.

Conclusion

The financial landscape in July 2023 exhibited notable trends across the NFT, GameFi, and Blockchain sectors. The NFT market flourished, fueled by rising cryptocurrencies and major brand involvements. Meanwhile, GameFi experienced a slight decrease in active users, but BNB Chain remained the frontrunner with a remarkable 154% increase.

Throughout the month, the blockchain sector showcased steady growth, reaching a significant market capitalization. Our profound gratitude goes to our esteemed sponsor, Footprint Analytics, for providing the essential data that fortified the accuracy of this report.

As we venture into the ever-evolving financial markets, staying informed remains vital for making sound investment decisions. We encourage our readers to keep track of developments and trends for a prosperous financial journey.

Thank you for joining us on this insightful exploration, and we eagerly anticipate providing you with continued valuable updates and analysis.