CryptOps ChronicleCryptOps Chronicle August 2023 Report

CryptOpsChronicle: August 2023 Report

Welcome to the CryptOpsChronicle August 2023 review. The purpose of this comprehensive report is to inform you about significant events, trends, and developments that have shaped the financial landscape throughout August, using in-depth analysis and statistics.

In August, the cryptocurrency world, specifically Bitcoin and subsequently, the altcoin market, experienced sharp declines. These abrupt price drops created an atmosphere of concern and panic among investors, increasing uncertainty in the market. High volatility pushed the boundaries of the crypto industry’s dynamics, urging investors to be cautious and prepared for market changes. Throughout this month, alongside negative price movements, there were significant developments in various sectors of the crypto world. This report will delve into all of these aspects.

Key Highlights

Sudden Bitcoin Price Drop: Bitcoin’s price experienced a sudden plummet on August 18, dropping by over 8% in just 10 minutes.

Coca-Cola Unveils “Masterpiece” NFT Collection: Coca-Cola introduced the “Masterpiece” NFT collection on Coinbase’s Ethereum Layer 2 network, Base, showcasing a fusion of traditional and modern art pieces.

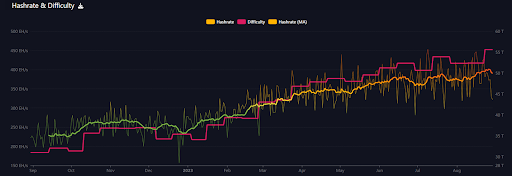

Bitcoin Mining Difficulty Reaches All-Time High: Despite the rapid decline in Bitcoin’s price, BTC mining difficulty reached a historic peak of 55.62T hashes.

Current State of the NFT Market: In August, the NFT market faced challenges such as declining volumes and lower profits for individual investors. However, despite this, the NFT market closed August with total sales exceeding $40 billion, surpassing the previous year’s total.

Binance Signals Entry into P2E Gaming: The GameFi sector, which experienced dramatic declines of up to 98% for top play-to-earn tokens like SAND, AXS, and GALA during the past summer, has come to life with a play-to-earn project signal from Binance’s official X account.

Grayscale Has Won the Bitcoin ETF Case Against the SEC: The court’s decision to review Grayscale’s ETF proposal has led to a significant increase in the price of BTC, pushing it back above the $28,000 level with a notable 5% rise.

Crypto

Overview of the Crypto Market:

In July, the cryptocurrency market showed mixed performance. Bitcoin and Ethereum paused after the excitement surrounding the BlackRock-ETF in June, while XRP’s legal victory gave momentum to other alternative cryptocurrencies, creating an 80% performance difference. However, overall, the cryptocurrency market had a relatively calm summer, with decreased trading volumes and reduced volatility.

Ether, considered a major crypto blue-chip in recent months, also experienced losses, dropping by 0.5% to $1,850.17 in August. It had already suffered a 3.35% decrease in July. This decline was influenced by a recent security vulnerability in the DeFi giant Curve.

As a result, the relatively calm trend observed during the summer months was disrupted somewhat in August. In particular, the sudden drop in Bitcoin’s price on August 18 significantly affected the altcoin market, causing unease among crypto investors.

Bitcoin Mining Difficulty Reaches All-Time High

Bitcoin mining difficulty reached an all-time high. On August 22, during the bi-weekly automatic adjustment, Bitcoin mining difficulty increased by 6.17% to reach 55.62 trillion hashes.

According to analysts, this sharp increase in Bitcoin mining difficulty indicates that miners believe the current BTC level is either at a fair value or slightly below its real value.

PayPal Launches Its Dollar-Backed Stablecoin

The $64 billion payment giant, PayPal, announced the launch of its own dollar-backed stablecoin called PYUSD on the Ethereum network.

This move is seen as a sign of PayPal’s confidence in blockchain and smart contracts, marking a significant step in the finance sector.

Litecoin Completes its 3rd Halving with a 6% Decrease

Litecoin completed its third halving on August 2. Following this, mining rewards were reduced by half, from 12.5 LTC to 6.25 LTC, with the block height reaching 2,520,000.

Before the halving, LTC had not been performing well, and following the event, its value dropped by approximately 6%, reaching $87.

Grayscale Has Won the Bitcoin ETF Case Against the SEC

On Tuesday, August 29th, the United States Court of Appeals accepted Grayscale’s review petition. A panel of three judges from the DC Circuit Court of Appeals sided with Grayscale Investments in its battle against the Securities and Exchange Commission.

The court’s decision to review Grayscale’s ETF proposal led to a significant increase in the price of Bitcoin, with BTC once again rising above the $28,000 level, experiencing an approximately 5% gain.

NFT

Overview of the NFT Market:

In August, the NFT market faced challenges such as declining volumes and lower profits for individual investors. Nevertheless, the NFT space continued to see ongoing development, funding, and strategic partnerships. Significant events included NFT integration on Instagram and Facebook, Animoca Brands Japan raising $45 million, and the announcement of PROOF’s ambitious plans.

August 2023 NFT Market Data:

- Total NFT Market Capitalization: $2.6 billion

- Daily NFT Trading Volume: $574.4 million

- Total NFT Transactions: 1.2 million

- Total Unique Users: 357.2k

- Buyer/Seller Ratio: 170.01%

August NFT Market Statistics:

Market statistics reflected falling prices for Bitcoin, Ethereum, and Solana. NFT trading volume remained low, accompanied by decreasing user numbers on OpenSea. Productive art collections stood out during a market downturn.

- Bitcoin Price: $20,330 (13.7% monthly change)

- Ethereum Price: $1,540 (5.3% monthly change)

- Solana Price: $32 (27% monthly change)

Among the top NFT collections, Ethereum featured Pudgy Penguin, YugaLabs, DigiDaigaku, and Moonbirds, while Solana saw strong performance from DeGods, Blocksmith Labs, and SolGods.

Despite challenges, the NFT market closed August with total sales exceeding $40 billion, surpassing the previous year’s total.

Coca-Cola Launches “Masterpiece” NFT Collection

Coca-Cola released the “Masterpiece” NFT collection on Coinbase’s Layer 2 network, Base, as part of the “OnChain Summer” event celebrating Base’s launch.

NFTs were minted on the mint.fun platform, with prices ranging from 0.0011 ETH to 0.014 ETH. The collection consisted of nearly 50,000 items, with production concluding on August 16.

Polygon Surpasses Solana in 30-Day NFT Sales for the First Time

Polygon surpassed Solana in 30-day NFT sales. Polygon Labs President stated that the blockchain processed over 3 million NFT transactions during the same period.

Polygon’s 30-day NFT sales chart recorded approximately $33.85 million, while Solana stood at $32.68 million in sales. Solana also experienced a notable decrease of over 57% in the past 30 days.

GameFi:

Overview of the GameFi Market:

- As of August, the total volume of the GameFi market reached $277,292,622.71.

- The total transaction volume in the GameFi market for the last 30 days was recorded at 572,163,898.

- The most popular web3-based game in August, Alien Worlds, had an average of 173,000 active users.

In August, the total number of games in the market increased by 2.38% compared to the previous month, rising from 2,566 to 2,627.

- BNB Chain had the most games with a 31.6% share, followed by Ethereum with 25.2%.

GTA Developers Launch “Sugartown” Web3 Game via Zynga

The developers of the GTA series, Take-Two, partnered with its subsidiary Zynga, acquired last year for $12.7 billion, to launch “Sugartown,” an Ethereum-based web3 game. This marks the first time a “major mobile game developer” has created a crypto-based game from scratch.

Players will use $ETH or ERC-721 tokens to access the game and have an opportunity to earn in-game currency. Additionally, access tokens called “Oras” will be used for minting when Zynga releases the first batch of 10,000 later this year.

Top P2E Tokens Dropped 98% in Trading Volume

Popular play-to-earn tokens like Axie Infinity (AXS), The Sandbox (SAND), and Gala Games (GALA) experienced a 98% drop in transaction volume in June, July, and August compared to their peak in November.

In July, P2E volume remained limited at $1.9 billion, a 94% decrease compared to January 2022. This downward trend continued throughout August. In the first week of August, The Sandbox’s SAND token traded at approximately $0.40, marking a 5.5% decrease.

Blockchain

Overview of the Blockchain Sector:

As of August, the total chain token market capitalization was $854.1 billion, with a total locked value (TVL) of $55.2 billion. Bitcoin led the Total Chain Token Market Capitalization Distribution with 59.7%, followed by Ethereum with 23.7%. The top five were as follows:

- Bitcoin: %59.7

- Ethereum: %23.7

- BNB Chain: %3.9

- XRP: %3.3

- Diğerleri: %9.4

Coinbase’s Layer-2 Network Base Achieves 136,000 Active Users on Its First Day

Coinbase’s Layer-2 blockchain, Base, surpassed the daily 100,000 active user milestone on August 10, the day after its official launch, outperforming its major competitor, Optimism.

Research data showed that Base quickly reached approximately 136,000 users following the surpassing of the 100,000 daily active user mark. Additionally, Base achieved approximately $175 million in bridged assets since its launch.

DeBank Launches Its Layer-2 Chain “DeBank Chain” Platform

DeFi blockchain discovery platform DeBank announced the DeBank Chain, a new Layer-2 blockchain built on Optimism’s OP Stack.

DeBank Chain was introduced as an “asset layer for social media.” Built as an optimistic rollup, it claimed to reduce Layer-1 data storage gas costs by 100 to 400 times.

Conclusion:

The cryptocurrency market in August was marked by sharp declines in Bitcoin and altcoins, leading to uncertainty and high volatility. Additionally, Ethereum’s losses served as a significant warning for investors to remain cautious about market changes.

The NFT market remained highly intriguing, with challenges in volume and profits offset by integrations on major platforms like Instagram and Facebook, continued financing, and strategic partnerships. August saw the NFT market closing with total sales surpassing $40 billion, exceeding the previous year’s total.

The blockchain world was also active in August. Coinbase’s Base Layer-2 network quickly gained users, surpassing Optimism. Additionally, DeBank introduced the DeBank Chain, aiming to significantly reduce data storage costs.

As we conclude this review, we would like to extend our gratitude to our sponsor, FootPrints Analytics, for their contributions in providing reliable data-based analysis and statistics that helped us compile the CryptOpsChronicle August 2023 report.

We also want to thank our valued readers for accompanying us in this report. We hope to return with new and updated data in our next report.